Current Projects

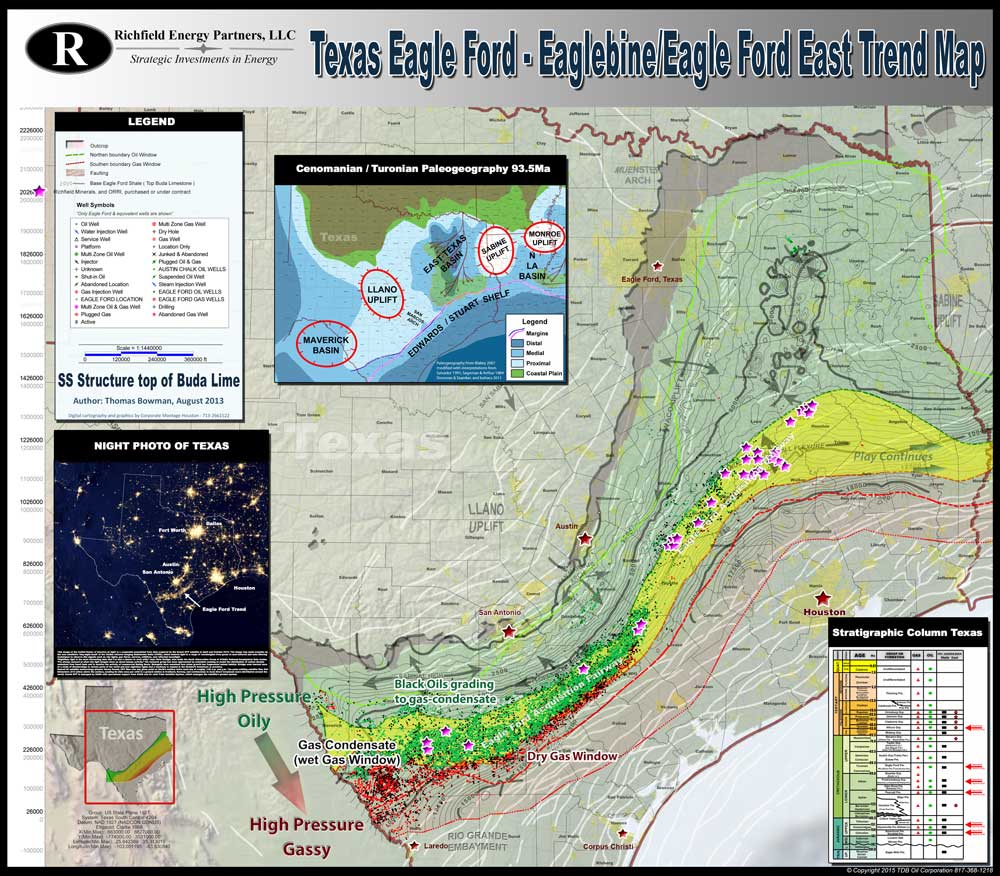

Richfield Energy Partners is currently focusing on the identification, evaluation, selection, acquisition and management of mineral interests, royalty interests and overriding royalty interests (the “Targeted Asset Class”) in properties containing unconventional oil and gas resources located within one or more promising geological formations that are being explored and developed along the Gulf Coast region of Texas, including, but not limited to: the Eagle Ford Shale Trend, the Eaglebine, Woodbine, Buda, Georgetown, Edwards and Glen Rose formations.

The Richfield Energy Partners Management Team seeks the highest possible risk adjusted rates of return through a disciplined strategic approach in selecting Targeted Acquisition Areas and specific Investment Opportunities within the Targeted Acquisition Area.

Building Value and Yield In the Portfolio

The time tested method to build value in a mineral and royalty portfolio is to invest in non-producing minerals in highly prospective areas with offsetting or a step out from proven economic production with best of class operators leading the way.

The Master Fund is an open end fund, as new capital is received, targeted properties are acquired. This allows Richfield Energy Partners the flexibility to adjust to and exploit changing market conditions.

Distributions are made monthly; an investment made in the current month will receive the initial return on investment the following month. Without the assurances of periodic lease bonus payment or the promise of timely development acquiring non-producing undeveloped properties in today’s commodity price environment would be dilutive in the near term to our limited partners.

In order to assure portfolio additions are accretive to monthly per unit distributions and to take advantage of prevailing market conditions since 2015 while increasing short term returns the Master Fund’s, acquisition criteria has evolved away from non-producing undeveloped properties to producing partially developed properties.

As commodity prices continue to recover and increase over time and the underlying price of producing partially developed properties follow suit, Richfield Energy Partners can once again deploy capital into highly prospective non-producing undeveloped properties.

Get in touch

Contact us anytime